Buying A Car? 5 Financial Tips For Your First Purchase

A car is usually one of the first big purchases most Malaysians make and probably the first big ticket purchase for many young Malaysians especially fresh graduates. Sometimes, buying a car in Malaysia is somewhat “compulsory” as it is considered unusual if you do not have a car of your own.

Buying your first car can be exciting and also can be super stressful without proper planning and good advice. The decision-making process is very daunting as we navigate car variables, cost, affordability, protection, maintenance, that come into play when considering purchasing a car, either new or used.

When purchasing a car, you must ask yourself these 2 important questions:-

▶️ “Do you need it?”

▶️ “Can you afford it?”.

The biggest misconception most first time car buyers have is that as long you can afford the down payment and the car loan installments, then you are “safe”.

Striking back to reality, getting a car is a big commitment albeit not as much as buying a house. If you’ve been wondering if you’re ready; I have got 5 Financial Tips that your should know as a first-time car buyer. Keep in mind, these are simple guidelines, not hard rules you must follow.

What Can You Afford?

If you are looking to buy a car, chances are, you already have an idea of one in mind.

This step may be the most tedious part of it all, it helps you figure out whether you are financially-ready to buy a car in the first place.

Different people will have different needs and reasons for wanting to buy a car. However, the biggest factor in choosing a car is your budget. It is an important step you should not take lightly!

If you have just graduated from university and entered the working world, go for a lower-priced car, you probably don’t want to burden yourself with an expensive loan.

Getting a car is a big commitment, mainly due to the costs that come from it. Budgeting will help you identify whether you have such money in your account or are just looking for a hard time.

Generally, there are 3 stages of expenses in every driver’s life, which are:

1) Monthly Costs – Car loan repayment, fuel, parking, toll costs and maintenance;

2) Annual Costs – Road tax renewal and car insurance;

3) Other Miscellaneous Costs;

4) Car Depreciation.

For most of us, taking a car loan is a quick-fix to a budget. However, consider how much you can set aside for the monthly instalment. Even though there is no hard and fast rule to determine how much your monthly salary should be allocated for your car installment, however, try to keep a limit of less than 20% of your monthly salary to service you car loan. Any amount more than that means you are overspending.

Making The Down Payment

When it comes to down payments, you need to know that the more you pay in the beginning, the less you will need to pay in the long run.

However, most purchasers may face challenges to come up with down payments. Those who are lucky enough may get their parents’ “to help out” while those who don’t, then they have to start saving for down payments even with their first month salary.

If you were to buy Axia 1.0 AV with 10% down payment and assuming you start to save RM200 a month, it would take you almost 21 months to save up RM4,142 [ (RM41,427 x 10%) / RM200 ] as down payment.

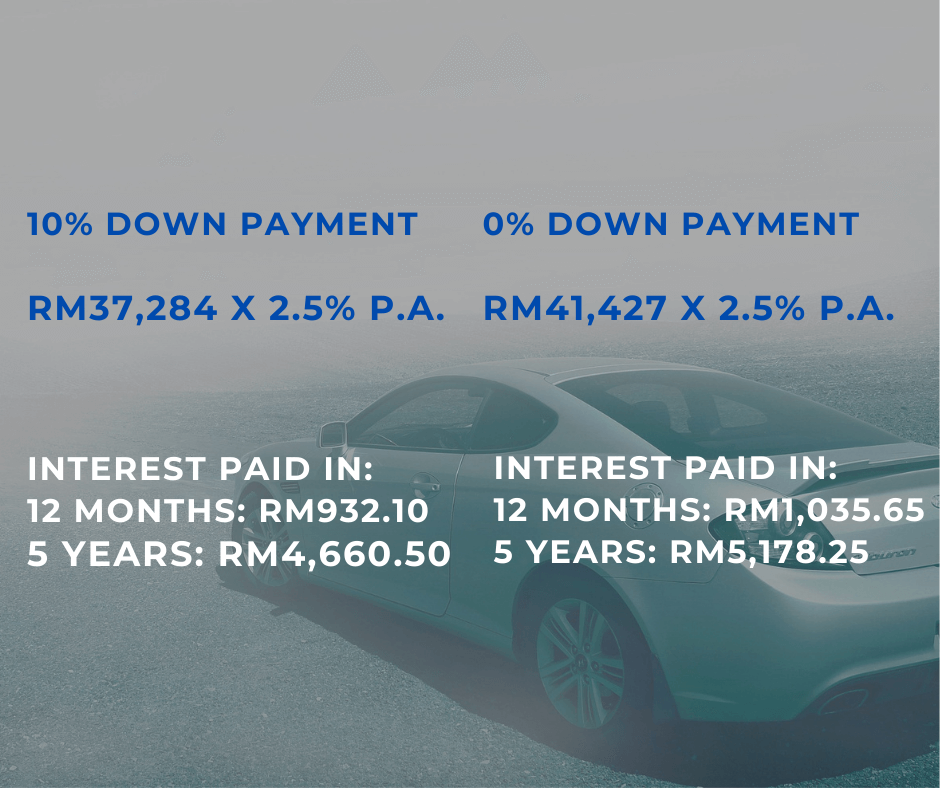

Let’s go back to earlier same example, Axia 1.0 AV model costs RM41,427 on the road. Most Malaysian banks currently require a minimum down payment of at least 10% of the total car value and typically charge an interest rate of 2.5% per annum.

Some banks might offer special purchase deals with 0% down payment. The catch is, this will often result in you paying more in interest because of the higher loan amount.

Comparing a 10% down payment and 0% down payment, over a five-year loan period at a typical interest rate of 2.5%, you actually end up paying about 11% more in interest. In this scenario, you pay RM517.75 more with 0% down payment.

Despite the benefits of making a larger down payment, be mindful to not cripple your finances or deplete your savings accounts with too large an upfront amount. Liquidity is extremely important.

Getting A Loan

Purchasing a car is a big investment, only second to property. So, it only makes sense for you to figure out what type of vehicle to purchase and how you are going to afford this car.

A car loan is a personal loan that is used to buy a vehicle. It works the same way as a secured personal loan whereby the vehicle you are purchasing is securitized against the amount of money you are borrowing.

Just like any other loan applications, there is a number of criteria that may determine whether or not you qualify for a loan. Those criteria include your income, employment type, current financial commitments, debt service ratio and some other lifestyle factors.

Banks usually avoid lending credit to those who are unemployed, as lenders want to see a stable, reliable income stream and employment is a likely indicator that you will be able to service your loans.

To speed up the approval of your car loan application, you can observe these tips before or during your car purchase:

Check Your Credit Score

Before buying a car, you need to know how much credit you can borrow from the bank. Banks typically assess this based on your debt service ratio (DSR).

DSR is a popular benchmark used to measure an individual’s ability to produce enough income to cover his/her debt payments. Having a good credit score means you are in the position to get more favorable interest rates and getting flexible payment periods, in turn potentially saving you up to hundreds, if not thousands of Ringgit. You could also have more options to choose from as most banks will prefer to deal with you.

In general, you will only be able to obtain a car loan if your monthly debt (including the one you are about to take), does not exceed 60% of your monthly net income.

It is important to note, those with a clean credit history (zero loan and credit card payment record), the chances of your car loan being approved by the bank is very low. Therefore, you need to build a credit history for minimum 6 months by getting a credit card for starters.

Poor to low credit score, which usually ranges between 300 to 651 according to CTOS is considered bad credit score, not only affects your chances of securing a loan, it may also be the reason you get rejected for a new credit card, have to pay higher interest rates, or even be denied a job.

If you have a poor credit history, you need to rectify your repayment habit by paying your loan or credit card on time and in full amount. Low credit score will lower your car loan approval rate because it’s a sign that you’ve been unable to manage debt.

If this is the case, it is advisable that you clean up your credit and clear up existing debts before you apply for a new loan. Eliminating a bad credit rating is not an overnight process, but clearing up your debt is a good start to get back on the right financial track. It is advisable to maintain a prompt repayment habit for up to 12 months before you next loan application.

Compare Car Loan Interest Rates

Since each bank offers different rates and terms on their car loans, it is important to shop around for the best interest rate deal before signing any contract.

The easier way to compare interest rates for car loan is via online, such as banks’ website. You will be presented with a list of all banks with their rates and terms, plus you can calculate your car loan easily and apply it online.

Get A Guarantor

If your desperate need for a car and your credit score is too low or zero, getting a person to guarantee the loan is your next best alternative.The guarantor, usually your parents or family members, will assume the same risks as the borrower. In case the borrower is unable to pay the monthly installment, the guarantor’s name and credit will be on the line too if he/she does not step in to mitigate it.

Payment History

Maintaining an acceptable if not satisfactory Payment History moving forward is equally important. To be successful in any loan application, it’s pertinent that applicants have and maintain good credit scores. A less than satisfactory score may lead to a rejected application.

Shop for Car Insurance

Take time to shop for car insurance, don’t rush through it.

The car you choose to buy will influence the type of coverage that you will need and vice versa. It is compulsory you car needs car insurance and a road tax to drive legally on the road in Malaysia!

Find a policy that suits your needs, has maximum coverage but at a minimum cost.

Stay Away From Low Resale Value Cars

We don’t usually stick a lot to our firsts, and the same goes to our cars.

Most likely, you are going to sell it off in a few years once your mobility needs start increasing or when you start earning more and are able to afford a fancier car.

Cars are pretty much like computers, electronics, clothes or shoes, i.e. they don’t last that long.

If you are on a limited budget especially buying your first car, you may not want to overspending on an item that will not last long. The goal is to keep the value of the car rolling until your next purchase.

Don’t waste your money could it be used for your other investments, include not changing your wheels or exhaust and intake, possibly end up voiding the warranty on your car.

For many of us, our first experience with anything holds significant value, the same goes to purchasing our first car. It is not a decision that can be made overnight or even after a month.

So don’t feel pressured to get it all figured out immediately. Overwhelming could well be an understatement but reminding yourself of the bigger picture will help keep the stress down, and hopefully your finances intact.

Ultimately, the goal is to buy a car at a relatively affordable price because, after all, you want to be an economic and sensible buyer.

I hope you found this article helpful !